Explore ISO 20022 migration and adoption in this comprehensive guide. Discover the benefits, challenges, and expert strategies to streamline your transition to the global financial messaging standard.

Banks and financial institutions worldwide are embarking on a transformative journey as they prepare to transition their payment systems. This change involves a shift from the traditional SWIFT message exchange network, also known as ISO 15022, to the newer, more advanced, and data-rich ISO 20022 financial messaging standard.

This transition signifies a global transformation within the payments industry. By embracing enhanced data management, it offers the promise of significant, long-term benefits for the global economy.

This guide aims to equip you with a thorough comprehension of ISO 20022, delving into its significant influence on the payments industry. It provides guidance on navigating the successful migration and adoption of ISO 20022, leveraging the support of real-time payments analytics and third-party monitoring solutions.

An introduction to ISO 20022

In the dynamic landscape of the global payments industry, the demand for seamless interoperability has given rise to ISO 20022, an internationally recognized financial messaging standard. This standard was meticulously crafted by the International Organization for Standardization (ISO) to cater to the evolving needs of banks and financial institutions worldwide.

The interconnectedness of the global economy has ushered in a new era of complexity in the payments sector. As a result, a pressing requirement emerged for a universal language to underpin the structure of payment messages across the entire industry.

ISO 20022 is more than just a standard; it's a flexible framework for payment messages that revolutionizes how financial institutions, their clients, and market infrastructures communicate. This transformation paves the way for frictionless payments and empowers businesses to harness the power of data. With its well-defined structure and dedicated fields for intricate payment details, ISO 20022 sets the stage for vastly improved communication efficiency in the realms of cross-border payments, real-time transactions, and high-value financial transfers.

Bid farewell to the era of managing a chaotic mix of diverse message standards. ISO 20022 now stands as the universal language, seamlessly uniting the global payments ecosystem.

What does ISO 20022 mean for the payments industry?

The adoption of ISO 20022 is nothing short of a game-changer for the payments industry. As the migration to ISO 20022 formatting for major currencies gains momentum, SWIFT's projections paint a vivid picture - 80% of global high-value payments by volume and a staggering 90% by value will soon be processed using this standardized framework.

In more than 50 countries, ISO 20022 will usher in the retirement of legacy domestic systems and payment standards, effectively dismantling the disjointed standards that have characterized cross-border payments for banks, financial institutions, financial market infrastructures, and even automated systems.

What makes ISO 20022 truly transformative is its ability to unlock enriched data sets, rendering manual intervention a relic of the past. This translates to end-to-end automation throughout the transaction life cycle, a monumental shift benefiting all stakeholders in the financial landscape. The newfound machine-readability heralds an era of unprecedented interoperability, fostering seamless connections between financial institutions and settlement networks, regardless of geographical boundaries.

The worldwide transition to ISO 20022, embracing major Real Time Gross Settlement (RTGS) and high-value payments systems, marks a revolutionary milestone. This initiative is a historic leap in the financial services industry, promising unparalleled efficiency, standardization, and elevated global connectivity.

What are the benefits of ISO 20022 ?

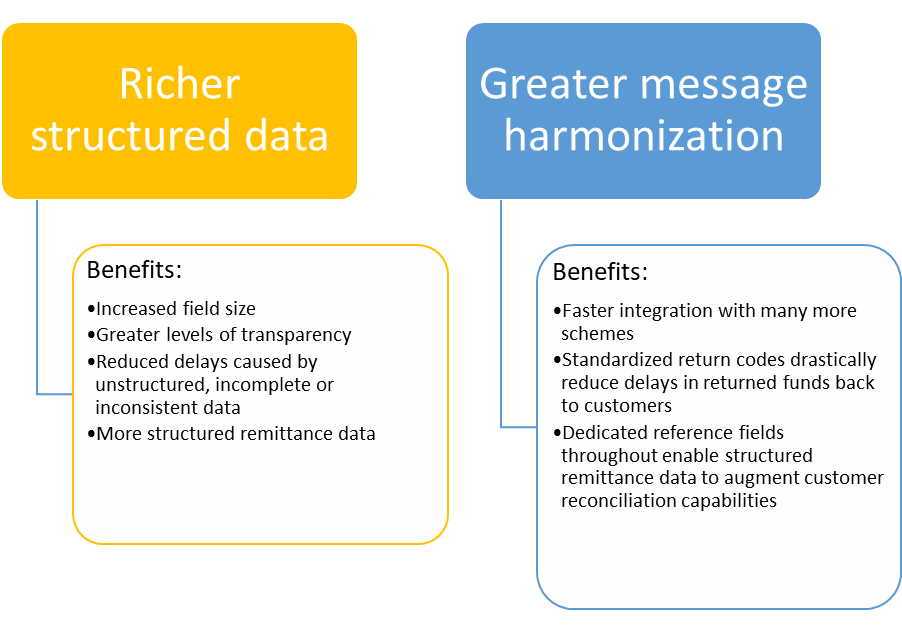

ISO 20022 adoption promises a multitude of benefits that have far-reaching implications across the entire payments ecosystem, benefiting financial institutions, market infrastructures, and ultimately, bank customers. While the advantages of migrating to ISO 20022 are abundant, there are two key areas that stand out, each with a ripple effect across various business processes.

Greater Efficiency:ISO 20022 acts as a catalyst for heightened efficiency in the payment ecosystem. By offering richer, structured data and expanded field sizes, it not only boosts transparency and strengthens security but also leads to a substantial reduction in processing delays. This results in a payments process that is not only smoother and more reliable but also significantly faster, with benefits rippling across the entire industry.

Improved Straight-Through Processing: ISO 20022 brings about a notable improvement in straight-through processing by reducing declines, rejections, and exceptions, coupled with enhancing reconciliation processes. This not only leads to substantial cost reductions throughout the entire payments chain but also minimizes the necessity for manual intervention. The streamlined operations and heightened efficiency in payment processing result in impactful cost savings felt at every level of the financial ecosystem.

Better Compliance and Security: False-positive compliance checks and the time-consuming investigation of missing key information have long been a challenge in international payments. ISO 20022, with its comprehensive data sets, provides a solution. It enables speedier processing for sanctions screening, fraud detection, and financial crime mitigation, resulting in better compliance and heightened security. This means not only faster transactions but also a more secure and resilient financial ecosystem.

More Efficient Returned Funds: ISO 20022 introduces standardized return codes for specific returns and investigation messages. This innovation translates into significant reductions in the time it takes to return funds to customers and ensures more prompt responses to inquiries from corresponding banks. Ultimately, this efficiency leads to higher customer satisfaction, faster dispute resolution, and a streamlined process for returned funds.

ISO 20022 Migration Timelines: Shaping the Future of Payments

ISO 20022, the global financial messaging standard, is steadily making its mark on the payments landscape. While it's already been embraced in 70 countries as a replacement for domestic or legacy formats, the worldwide adoption of ISO 20022 is poised to unfold over the next few years.

Payment Market Infrastructures (PMIs): These institutions, the custodians of major global currencies, are not merely adapting – they're orchestrating a symphony of change. Some have already completed their ISO 20022 migration, while others are in the throes of embracing this standardized framework. The calendar is marked, and the collective rhythm points to November 2025—a date not just circled, but imprinted with the promise of a future where financial landscapes are united in a common language. It's more than a transition; it's a harmonious evolution.

SWIFT's Roadmap: To facilitate this transition, SWIFT, a key player in global financial messaging, has rolled out a comprehensive roadmap. The roadmap encompasses the migration of existing message types, including series 1, 2, and 9, and it's set to kick off in March 2023. The roadmap outlines a carefully planned path that leads to the culmination of the coexistence period in November 2025.

Challenges of the ISO 20022 migration

As the countdown to the international standardization of ISO 20022 in cross-border payments ticks away, a wave of complexity is washing over banks, financial institutions, and global payments providers. The hurdles of adopting this new industry standard are surfacing prominently.

Translating Legacy Tech to ISO 20022: The complexity of ISO 20022 demands a recalibration of strategies for payments providers entrenched in legacy technology. In ensuring alignment with Anti Money Laundering regulations, conducting compliance checks, and fortifying fraud prevention measures, the integration of a new translation system emerges as a critical element within the ambit of migration plans.

Upgrading Aging Legacy Systems: Shifting from the MT format legacy system to a common language like ISO 20022 poses a significant challenge. The absence of native support for ISO 20022 format necessitates the updating or replacement of aging legacy systems. However, this evolution, especially in interconnected environments, presents a financial quandary that requires consensus among stakeholders.

Following the Right Timeline: In the realm of cross-border payments, precision in planning the migration strategy is paramount. Various deadlines for ISO 20022 adoption underscore the importance of meticulous timeline adherence. Striking the right balance becomes the key to a seamless transition.

Implementing New Data Management Strategies: The elongated messages of ISO 20022, amplified compared to the MT format, usher in a new era in data management. Beyond the concern of data loss, the emergence of multiple repetitive sections demands a reimagination of data management infrastructure. Every character within a message must align perfectly with specifications. The format undergoes rigorous validation at multiple points in the communication chain, both on the sending and receiving ends. The absence of even a single colon holds the potential to halt a multi-million transfer, leading to rejection or days of delay.

In the face of these challenges, the transition to ISO 20022 isn't just an upgrade; it's a strategic maneuver demanding careful planning, technological finesse, and an unwavering commitment to precision.

Techzert: Your Trusted Partner for ISO 20022 Migration Services

Navigating the complexities of ISO 20022 migration can be a daunting task, but with Techzert as your trusted partner, the journey becomes smoother and more manageable. Techzert is dedicated to helping financial institutions, banks, and payment service providers make a seamless transition to the ISO 20022 standard. Here's how Techzert can assist:

- In-Depth Expertise: Techzert boasts a team of experts well-versed in ISO 20022 migration services. They understand the intricacies of the standard and can guide you through the migration process with precision.

- Customized Solutions: No two organizations are alike. Techzert takes the time to understand your unique needs and tailors solutions that align with your specific requirements, ensuring a smooth transition that minimizes disruptions.

- Data Migration: One of the core challenges in ISO 20022 migration is data translation. Techzert offers data conversion services, ensuring that your existing data seamlessly aligns with the ISO 20022 format.

- Integration: Techzert's team excels at integrating ISO 20022 into your existing systems and infrastructure. This includes aligning your systems with industry standards and real-time payment analytics.

- Compliance and Security: Staying compliant with ISO 20022 and regulatory requirements is paramount. Techzert assists in ensuring your processes meet the required standards and enhance security and fraud detection.

- Monitoring and Maintenance: ISO 20022 migration is not a one-time event; it's an ongoing process. Techzert provides monitoring and maintenance services to keep your systems up-to-date and secure.

- Cost Efficiency: Techzert is committed to ensuring that ISO 20022 migration is a cost-effective endeavor. By streamlining processes and reducing errors, you'll benefit from cost savings over the long term.

With Techzert as your partner for ISO 20022 migration services, ISO 20022 migration becomes a strategic advantage rather than a challenge. Your organization gains access to a wealth of knowledge, experience, and customized ISO 20022 migration services, ultimately leading to a seamless transition to the ISO 20022 standard.

Talk to Our Expert

Our Services

ISO 20022 (MT to MX) Adoption & Migration

FTM For Corporate Payment Services

IBM Cloud Park For Integration (CP4i)